Tax credits for Iowa homeschooling families?

Yes!

Thanks to the efforts of Homeschool Iowa, in partnership with an Iowa Legislature and Governor willing to tackle significant education reform, this is now a reality!

UPDATE:

The Iowa Department of Revenue has now officially filed and published their regulations for the new Iowa Code section opening Tuition and Textbook Tax Credits to homeschoolers.

Prior to the rules release, the IDOR published some guidance on its website.

It did not match with what we understood Iowa Code Section 422.12 to say about the tuition and textbook tax credit. We were also quite certain the guidance did not match the intent of the legislators who changed the law to include homeschoolers.

Our legal counsel and lobbyist worked with the IDOR and key legislators to assure that the adopted rules would accurately reflect the Iowa Code and legislative intent.

Click on the button below to view the now-published regulations. Find the Tuition and Textbook Tax Credits section on pages 3-5.

Giving Credit Where Credit Is (Over)due

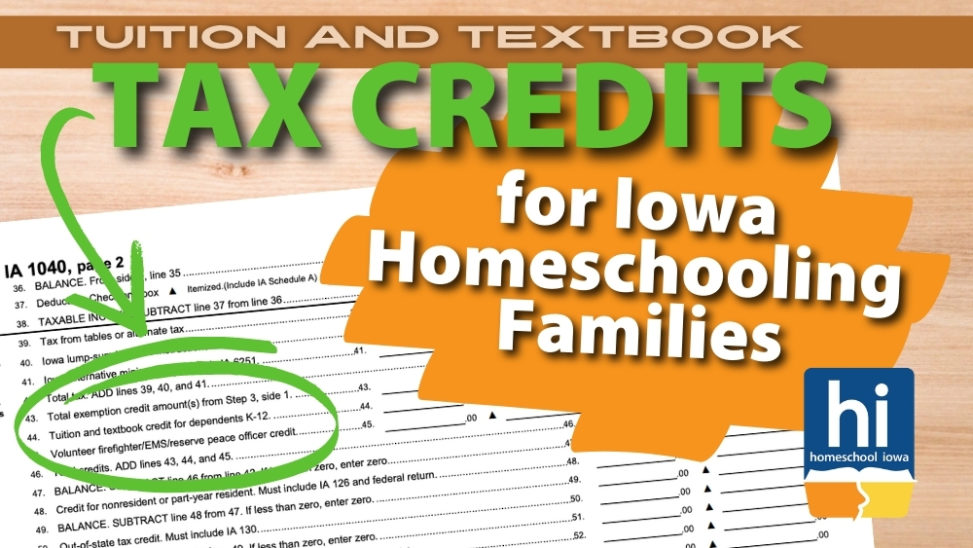

Since 1987, Iowa has allowed a “Tuition and Textbook Credit” for certain school-related expenses incurred by parents for their children's education.

Located in Iowa Code Section 422.12(2), the credit has been 25% of up to $1,000 in eligible expenses for each K-12 dependent.

However, the law limited the credit to those with dependents enrolled in an accredited public or private school.

Parents of homeschooled students (or nonaccredited private school students) were not allowed access to this tax credit option.

If homeschooling parents incurred the same types of expenses—or even the exact same expenses—as other parents, they were not allowed the same tax credit as their neighbors.

At Last, Equal Access Becomes a Reality

After many long years, and more than one stalled effort to end the discrimination against homeschool parents on this issue, equality has been achieved.

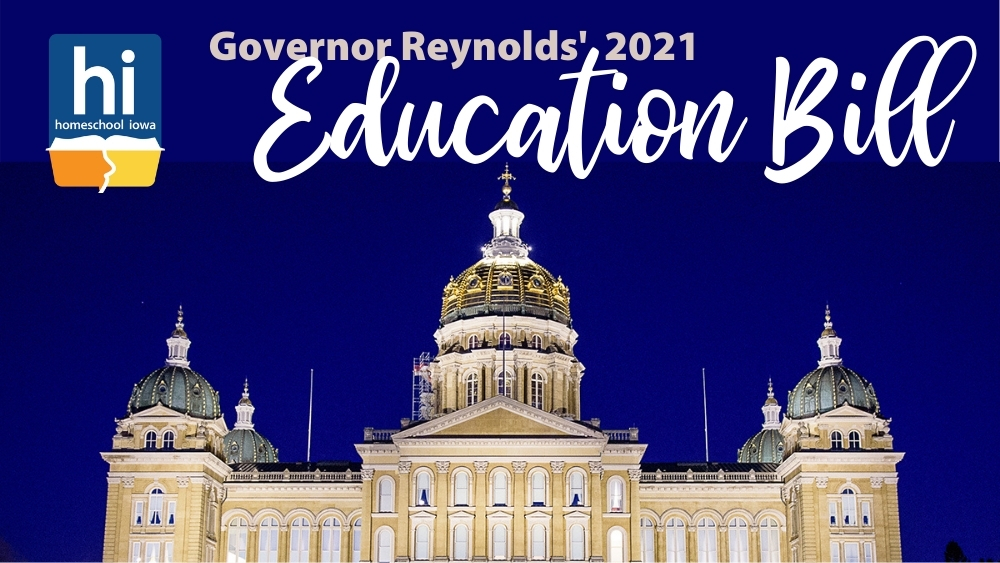

On May 20, 2021, Governor Reynolds signed into law HF 847, ushering in tax credits for Iowa homeschooling families.

Now parents providing private instruction

may also claim

the Tuition and Textbook Credit

for qualifying expenses

incurred for a dependent.

And the new access includes the 2021 tax year.

But there’s more!

In addition to ending the discrimination against homeschool parents for the Tuition and Textbook Credit, Governor Reynolds also proposed a higher cap on the qualifying expenses. The Legislature agreed.

Starting in 2021, the credit may be taken for 25% of up to $2,000 in qualifying expenses, effectively doubling the credit for each dependent.

So what qualifies for this tax credit?

The definitions are broader than one might think.

The Department of Revenue has officially adopted and published their administrative rules that define what qualifies for the tax credit.

(Check pages 3-5 in the linked document.)

What are some general guidelines?

The Iowa Department of Revenue's proposed rules indicate that, for the purposes of the tuition and textbook tax credit, "textbooks" mean books and other instructional materials used to teach only those subjects legally and commonly taught in public elementary and secondary schools in Iowa.

It can include fees or charges for required supplies or materials for classes in art, home economics, shop, or similar courses.

It can also include books and materials used for extracurricular activities.

It does not include amounts paid for books or other instruction materials used in the teaching of religious tenets, doctrines, or worship.

The IDOR also defines "tuition" as any charge for the expense of personnel, buildings, equipment, and materials other than textbooks.

Some examples include: pocket folders, binders, spiral notebooks, loose-leaf paper, writing utensils, backpacks, rulers, calculators, scissors, and computers (including rental fees paid to a school for the use of a computer).

Stay Tuned!

We will continue to update this page when new information is provided on tax credits for Iowa homeschooling families.

Below is a link to the Iowa Department of Revenue's website page that provides their guidance for taxpayers.

Bill Gustoff, who wrote this post, served as our Homeschool Iowa Lobbyist when these tax credits were expanded to homeschooling families. He devoted many hours and much effort at the Iowa Capitol on behalf of Iowa homeschoolers.

Bill, a homeschooling husband and father, is now serving as a member of the Iowa House of Representatives.

Our new Lobbyist, Jeremy Vos, is leading our Homeschool Iowa Advocacy Team.

Learn more about Jeremy and our new advocacy initiatives here.

Email [email protected] if you are interested in joining this team.

And, if you're not yet signed up for our Homeschool Iowa VoterVoice system, do so right now! You'll stay informed and be provided with simple tools to use when contacts with our lawmakers and government officials are needed.

Do you appreciate

Homeschool Iowa's efforts

toward gaining this tax credit

for Iowa homeschooling families like yours?

If so, please help us continue to advocate

for homeschooling families in Iowa

by becoming a Homeschool Iowa member.

CHECK OUT MEMBER BENEFITS AND

JOIN NOW!

13 Comments on “Tax Credit For Homeschooling Families in Iowa”

Thankful for all your hard work and support for homeschooling Iowans.

Hello, my tax person will not let me use this new tax credit since I’m not a licensed teacher what do I need to provide to use this?

You can refer your tax preparer to the Iowa Code. Taxpayers with students under either public or private instruction can claim Tuition & Textbook Tax Credit without being required to have an Iowa teaching license.

https://www.legis.iowa.gov/docs/ico/section/422.12.pdf

Would a science creationism curriculum be ineligible for tax credit?

I’m trying to discern between the “books and other instructional materials used to teach only those subjects legally and commonly taught” and the part about “does not include amounts paid for books or other instruction materials used in the teaching of religious tenets, doctrines, or worship”.

Science is a subject commonly taught, yet not a creationism view…???

What about Abeka material? BJU? Rod and Staff?

My tax person instructed “nothing religious”…

I’m just confused as to what I can actually honestly deduct… thanks for any help someone might be able to offer.

We are not, of course, attorneys or professional tax return preparers, but we can confirm that textbooks providing science instruction do qualify for the tax credit. If a textbook’s primary purpose is to teach religious tenets or doctrines, it would not qualify. Textbooks that are primarily designed to provide science instruction would qualify.

A creationist view would not be a science textbook. This is clearly a religious view, which is not confusing since you quoted that as an exclusion. I think what you mean to say is you think it should be included. That doesn’t make it so.

Curious if tutoring for dyslexia could be included under this? We have been through the psychologist diagnosis and tutoring recommended. It appears that we will be able to deduct at the federal level, but not feeling that it is covered under this bill. Can’t hurt to check!

Please bear in mind that Homeschool Iowa cannot give legal or tax advice. We must always refer you, our members and readers, to your own legal and tax advisors. However, you should consider that even those advisers can vary in opinions on these issues, and some of these questions are new to everyone.

As in most cases, we homeschooling parents must be our own best advocates. You can check the actual wording in Iowa Code 422.12 and in the Iowa Department of Revenue’s Administrative Rules (linked in the post above).

If you’re working with a tax preparer to help you with your form 1040, you can present the information that you have gleaned from your research and then rely on his or her advice as to what is acceptable for the tuition and textbook tax credit. If you don’t think you’re getting good advice, consider searching for other legal or tax advisors for additional guidance.

Would tuition cost for attending a co-op homeschool program be eligible under the new tax laws? I have a child that is dual enrolled with our public school, utilizing HSAP.

While Homeschool Iowa is not able to provide tax preparation counsel, we can refer you to this page on the Iowa Department of Revenue’s website that offers guidance for tuition and textbook tax credits.

https://tax.iowa.gov/expanded-instructions/tuition-and-textbook-credit-k-12-only-2021

Pingback: Amber

if we own a piano or a guitar and the child’s education requires the piano be tuned or the guitar strings be replaced or new guitar picks be purchased, etc., can those be included in the tax credit?

Hello, Anthony!

While we are not tax advisors or attorneys, we can tell you that the Iowa Department of Revenue’s administrative rules do include provisions for such expenses being used to receive the tax credit.

Here is Item 11 in the administrative rules’ list of specific expenditure examples related to a student’s participation in or extracurricular activities offered in the course of private instruction that may qualify for the tuition and textbook tax credit:

“Trumpet grease, woodwind reeds, guitar picks, violin strings, and similar types of items for maintenance of instruments used in bands or orchestras.”