8

HOMESCHOOLIOWA.ORGW

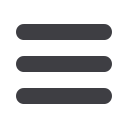

e all want our children to be good stewards of the

bounty God has given and to grow into responsible

adults when it comes to money. Yet most of us had

little or no formal financial training ourselves. I’m frequently ap-

proached by parents who ask,“How do I even begin teachingmy

child about money?”

Over the years, I’ve gathered practical

money lessons and fun training activi-

ties parents can use. Keep in mind that,

like any learning, their lessons must be

age-appropriate. And of course, kids

learn best by participation and exam-

ple, not by being lectured!

Here are five lessons to help your kids

learn great money habits — and have

fun doing it:

1. Money is Exchanged for Things

(ages 4-8)

Kids don’t necessarily make the connection between money

and the groceries, clothes and toys that show up in your home

— especially if they only see you take that plastic card out of

your wallet at the store! Use the following activities to reinforce

that connection.

Sort coins and bills together. Depending on their age and

math skills, you can have your children stack ten pennies to

equal a dime or even have them make change.

Make shopping lists together. Let your child help make the

grocery list. Show them how you decide what you’ll need at the

store. Explain why you don’t include other items on your list.

Pay cash at the store. Paying cash has two benefits. First, it

will help your child grasp the connection between money and

buying things. Second, studies show that you’ll actually spend

about 20% less—without feeling deprived!

Let your child choose and buy a small item with coins. Let him

or her count out the coins for the right amount to the cashier.

The extra time this takes will be well

worth the confidence your child gains!

2. Creating Spending Plans (ages

4-12)

Even young children can begin to de-

cide how they will spend their money.

Older children can set longer term

goals and manage larger amounts.

Create “Spend, Share and Save” im-

ages. Discuss what each category

means. “Spend” is for things they will buy that week (or, for

older kids, within that month). “Save” is the money put away for

a larger purchase or goal. “Share” is the money they will give to a

worthy cause of their choice or tithe to your church. Have them

cut out or draw images that represent these concepts for them.

Set simple goals for each category. Young children’s goals

must be very simple and not very far out into the future! But

even a four year old can set a goal to “save $1.50 for the poor

children.”Write these simple goals on a sheet of paper.

Make “Spend, Save and Share” envelopes. Have your child

make colorful envelopes for the three basic parts of their spend-

ing plan. Every time they receive money, have them immediately

divide it into these envelopes.

5 Lessons for Raising Financially Savvy Kids

BY PAMELA YELLEN

“The greatest gifts you can give

your children are the roots of

responsibility and the wings

of independence.”

~Denis Waitley